Hey everyone! So, you’re thinking about diving into real estate? Whether it’s your first rental or your first home, I’ve got something that might just blow your mind. What if I told you you could live in a property and have someone else help cover your mortgage? Yeah, that’s right!

The Smart Move: Live and Earn

Picture this: you buy a home that doubles as an income generator. That’s right! With the right place, you could snag about $100/month in cash flow. It’s not just about owning a home; it’s about making it work for you.

Crunching the Numbers

Let’s break it down:

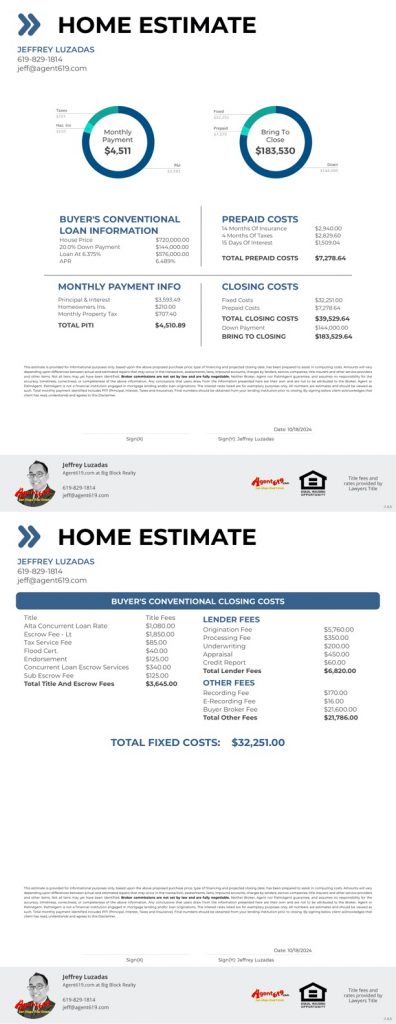

- Purchase Price: The seller might be getting anxious, so they dropped the price from $749k, down to an affordable $720k. That’s a $30,000.00 Savings

- Rental Income: This property has two, 1-bedroom units. Each unit has an estimated rent of $2300 per month. So second grade math says that $2300 + $2300 = $4600 of rental income

- Expenses: Don’t forget about property taxes, insurance, and maintenance. Based on the figures above, your expenses could be about $4511/month

- Cashflow: So let’s bring it all together! If we receive $4600 of rents, then minus $4511 of mortgage costs, then our cashflow is $89/month. Not bad for your first time at the rodeo! But wait, it get’s better. If we increase rent at 10% a year, then by 2nd year, you’ll cashflow $549/month. Then it get’s better in the 3rd year, cuz if we follow the same formula, you’ll get $1055/month; and so on. Can you see your bank account growing now?

By crunching these numbers, you can create that sweet initial $100/month cash flow. It might not seem like much at first, but trust me, it adds up and helps build your wealth over time.

Ready to Roll?

If you’re ready to take the plunge, let’s chat! I’m here to help you find that perfect property that fits your cash flow plan.

Hit me up, call or DM me today to schedule a private tour of some fantastic homes. Let’s find a place where you can live your life while making your money work for you. Sound good? Let’s do this!